Motor tax: Deputies want States to look into bringing it back

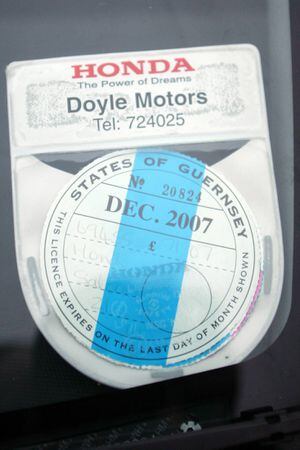

RE-INTRODUCING an annual motor tax to Guernsey could be back on the table if an amendment from two Vale deputies succeeds.

The States is set to debate the future of motor taxation next week.

Policy & Resources is keen to see a distance-charging mechanism introduced, which would ensure islanders pay based on their vehicle usage, as a way of sustaining revenues as use of fuel continues to fall.

It is calling for research to be carried out into how data would be collected and an appropriate charging structure.

The policy letter would rule out an annual motor tax charge being introduced.

But deputies Neil Inder and Laurie Queripel have submitted an amendment which would see P&R investigate the advantages and disadvantages of an annual charge based on the ownership of vehicles, alongside the investigations into distance charging.

Deputy Inder said he was keen for the idea of an annual charge not to be ruled out.

‘I don’t think it’s been utterly precluded by this House,’ he said.

‘And when this comes back to the States this will be a different government [as it will be after the 2020 election].

‘I want to make sure the government has the option to consider an annual charge.’

There are more than 50,000 combustion engine vehicles in Guernsey. Deputy Inder said if a £100 annual charge was introduced, that would raise £5m. a year – a quarter of what the States wishes to get from fuel duty.

This could then see fuel duty cut.

Deputy Inder said he had not had much feedback from the public about the Policy & Resources proposals – either in favour or against.

He added that he was concerned about how Policy & Resources was looking to implement a distance-charging mechanism.

‘I do about 10,000 miles a year,’ he said.

‘Do I take it in each year? Or do I self-certify? I can’t think of any technical device that can send the information to a centralised system. Distance-charging seems overly complicated, highly impractical and I can’t see how it can be done cheaply in Guernsey.’

This year the States expects to get £20.3m. from fuel duty.

The volume of motor fuel used has declined from nearly 34m. litres in 2008 to less than 30m. in 2018, a cumulative decrease of 14.2%.

Between 2008 and 2018, the excise duty rate on motor fuel has increased by 38p per litre (approximately 130%), which substantially exceeds inflation by 29p.

P&R is also asking members what should happen to fuel duty rates in the next two years.

They will have the option of freezing the rates, increasing them in line with inflation or maintaining their value.

Next week’s States debate starts on Wednesday.