OPINION: ‘Reduce costs, grow economy’

Deputy Nick Moakes explains why he believes we should explore all the other options before resorting to raising taxes

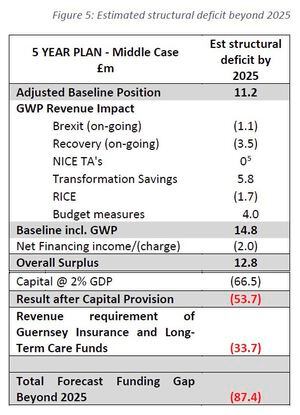

THE recently published Tax Review document is stark. By 2025, Guernsey will have a structural deficit of circa £87.4m. per annum and growing. Judging by the number of letters and emails that I have received over the last few weeks, tax is a highly emotive subject and any proposed changes to the current system will divide opinion.

So, why is this review happening now? One of the reasons is because of the world’s changing demographics.

After the Second World War, the birth rate increased dramatically, creating a ‘baby boom’. Those children are now at or approaching retirement age.

According to the Tax Review, between 2019 and 2040, the number of 65- to 84-year-olds is projected to increase by 40% and the number of people aged 85 and over is projected to increase by 123%. In contrast, every other age group is projected to fall (see Figure 3, below right).

This is not just an issue for Guernsey, it is an issue that affects most countries around the world. You might ask why this has suddenly become a problem? The blame lies squarely with politicians, not just in Guernsey, but around the world, who have for years side-stepped the social and economic consequences of the planet’s changing demographics.

Let’s be clear, changing demographics is not the only reason that we are facing a growing structural deficit in Guernsey. Successive governments have committed to spending money without facing up to the fact that they need to pay for these commitments. In addition, opportunities to reduce costs and streamline government have failed and/or been missed, which has compounded the problem.

Looking ahead, we have got to ensure that we have the funds to both care for our ageing population and invest in our children’s future.

So, what now? Do we tax, do we save, or do we grow the economy? Or a combination of all three?

The easy thing to do would be to raise taxes. Income tax, social security, GST or maybe a mixture?

Well, I am sorry, but I do not think that we should raise taxes until every other option has been fully explored and I will certainly not be supporting GST.

So, having ruled out GST, am I going to be one of those politicians who continues to kick the can down the road? No.

We urgently need to find ways of closing the States’ income and expenditure gap. If, after turning every stone, it transpires that there is still a gap, we will need to introduce tax rises (Plan B) because it would be fiscally irresponsible not to do so. However, that is not what I want to do, so let’s look at other options first (Plan A).

Commitments and savings

There has been some confusion about what has or has not been included within the Tax Review. I have read through the document and engaged with several committees, together with the Corporate Accounting and Treasury Team, to try to clarify a number of points. I have used Figure 5 (below left) as my baseline.

Only spending commitments in the recently approved Government Work Plan have been included. Therefore, the following commitments are contained within Figure 5.

Increased demand for health – £5m.-£10m. over five years.

Increased demand for States pension – £8m.-£10m. per annum – now estimated to be £28m.

Increased demand for Long Term Care Fund – £7m.-£23m. per annum.

NICE Drugs – £5m.-£12m. per annum – is included within the baseline in Figure 5. (Note: The GWP Revenue Impact line was for any savings that came about through phasing, which was not the case.)

Loss of revenue from secondary pensions – will rise to £9m. per annum over time.

However, the following are not included because they are not part of The Government Work Plan:

Parity in terms and conditions across different public sector staff groups – £35m.-£40m. per annum.

Reform of primary care – £9m.-£20m. per annum – now estimated to be £20m., possibly more.

There also seems to be some confusion about what ‘parity in terms and conditions across different public sector staff groups’ actually means. The law already requires men and women to be treated equally in relation to terms and conditions. So, we need more clarity. One thing is for certain, I do not believe that it is right to use £35m.-£40m. of taxpayers’ money to level up civil service terms and conditions.

I understand that the reform of primary care will not be going ahead at this time.

By permanently deleting both of these items, we could remove £55m.–£60m. per annum in future expenditure.

It is also a pity that the vote on NICE drugs took place before the Tax Review because if the introduction had been delayed (not stopped), that could have saved us millions of pounds in the short term.

And there you have the problem in a nutshell. The States seems happy to spend taxpayers’ money but is reluctant to explain where the money is coming from. During this term, more legislation will come before the States for approval. I ask all members of the States to think very carefully about how we spend taxpayers’ money and how we can save money and generate incremental revenue rather than simply spend, spend, spend.

Every committee could, if it wanted to, come up with savings that will not damage the island’s economy. We must live within our means and sometimes that means we simply can’t afford everything. We are a small island and cannot expect and probably do not want to replicate everything that far larger economies provide.

Then there is the reform of the civil service, which is long overdue, but has now begun. Savings can be made in, for example, the size of government, procurement processes and consolidation of office space. What about selling or redeveloping unused States property and land? The States has a huge property portfolio that could be worth circa £2bn.

Another area that needs looking at is capital spending. There has been an almost complete lack of spending on infrastructure over the last few years so I am pleased to see that we now plan to invest in our island by spending up to 2% (£66m. in 2025) of GDP on capital projects. However, I do question whether we will spend that much or why other forms of funding cannot be used. The projected capital spend is 76% of the structural deficit so finding an alternative source of funding could dramatically reduce the £66m. (2025) cost and cut the deficit down to a far more manageable size, always remembering that any debt must be serviced and paid back.

Economic growth

There are currently hundreds of open job vacancies on the island, with some sectors being more affected than others. For example, hospitality is struggling to fill roles, which means they cannot operate at full capacity. The result of this is that we are losing valuable taxes and social security payments on every one of these open positions. In addition, we are also losing out on tax revenue from lost sales. A double whammy.

Unemployment peaked at 5% during May 2020, a result of the pandemic. By June 2021 it had reduced to 1.4% versus 1.1% just before the first lockdown. This is good news, but we need to help everyone who can work get back into work so we can fill some of these vacancies.

Referring to Figure 3 once again, are we accepting that the number of people at retirement age or over will increase dramatically while the number of people in every other age group will decrease?

Some people might think that the changes in the island’s demographics are a foregone conclusion. I disagree. We need to repopulate as many of the younger age groups as possible so that the working population does not decline as projected. How on earth are employers otherwise going to fill roles as people retire?

To do this we will need to do much more to attract overseas workers. And what about our home-grown talent? Some of our children go off-island to school or university. We need to do far more to attract them back to Guernsey. To do this, we need to urgently address the chronic shortage of affordable housing.

Summary

I do not think that we should raise taxes until every other option has been properly explored. If there is still a gap between income and expenditure, I reluctantly concede that we will need to increase taxes because to not do so would be fiscally irresponsible. However, I will not vote for GST.

I believe that there are real opportunities to reduce the projected structural deficit if we want to. The States will need to pivot from a ‘spend and worry later’ mentality to a more considered approach. Reduce costs, grow the economy and invest in Guernsey’s future. But this will depend on individual deputies and committees. If we do not adopt this approach and continue to come to the States demanding more money, the only option will be to raise taxes.