Inflation jumps to five-year high, boosting chances of interest rate hike

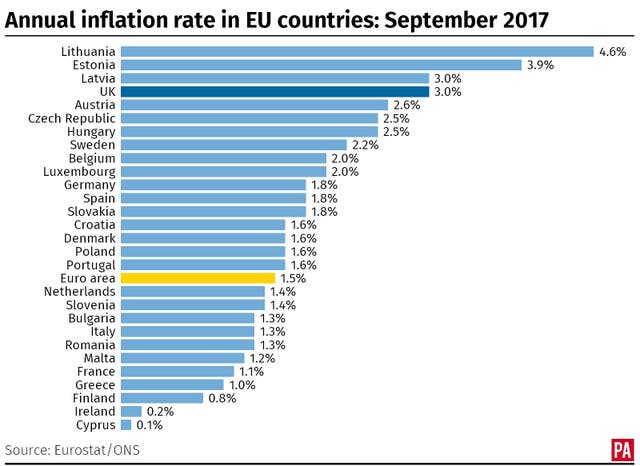

Official figures show the Consumer Price Index measure of inflation reached 3% in September, up from 2.9% in August.

Inflation surged to its highest level for more than five years last month, increasing the financial pressure on households and boosting the prospect of an interest rate hike.

Figures from the Office for National Statistics (ONS) showed the Consumer Price Index (CPI) measure of inflation reached 3% in September, rising in line with expectations from 2.9% in August.

The step-up in CPI was driven by higher food and transport costs, pushing the headline rate to levels not seen since April 2012.

The state pension is linked to last month’s CPI rate, meaning the amount dished out by the Government will increase by at least 3% next year.

The triple-lock on pensions ensures that recipients are guaranteed a minimum increase each year by whichever is the highest out of September’s inflation rate, average earnings or 2.5%.

Andrew Sentance, PwC’s senior economic adviser, said: “This latest rise in inflation will add to the squeeze on the spending power of consumers and is likely to prolong the period of sluggish growth we are currently seeing here in the UK.

“A further rise in the inflation rate later this year cannot be ruled out.

“A gradual rise in interest rates would help support sterling and reduce the risk that the current surge in inflation becomes more prolonged and persistent.”

September’s jump in CPI placed Bank of England governor Mark Carney on the brink of having to write a letter to Philip Hammond explaining why inflation is rising so rapidly.

There is growing speculation that the MPC could raise interest rates next month, particularly after minutes from its September meeting showed all policymakers believed “some withdrawal of monetary stimulus was likely to be appropriate over the coming months”.

The Retail Price Index (RPI), a separate measure of inflation used to set next year’s business rates, was unchanged last month at 3.9%.

Despite coming in shy of forecasts, the RPI rate still means English businesses will face a rates rise of £1.1 billion next year.

Benefit claimants have also been bruised by September’s CPI rate, as the Government’s decision to freeze working-age benefits in cash terms until March 2020 means £450 a year will now be shaved off some state handouts in 2019/20.

A Treasury spokesman said: “We understand that families are feeling the effects of inflation and we are helping them with their living costs.

“We’ve frozen fuel duty, doubled free childcare for nearly 400,000 working parents and cut income tax for 30 million people.

“Increases to the National Living Wage are also delivering the fastest pay rise for the lowest paid in 20 years.”

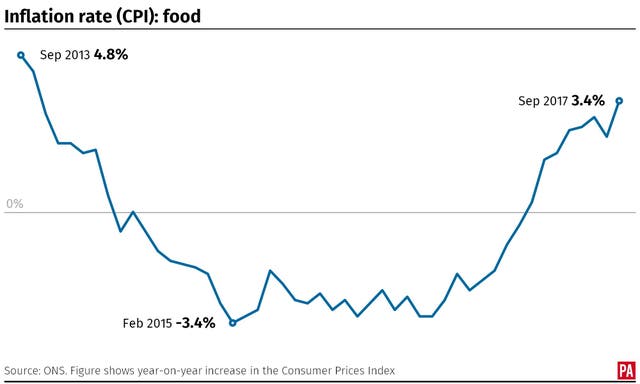

Focusing on CPI, the ONS said food and non-alcoholic drinks rose by 0.8% month on month in September after falling by 0.1% over the same period last year.

On an annual basis, prices rose by 3% last month, the highest since October 2013 when they climbed by 3.9%.

Transport costs put upward pressure on the headline rate, recording a smaller month-on-month fall of 1.3% in contrast to a drop of 2.3% in 2016.

Fuel prices also pushed higher, with petrol and diesel both stepping up by 2.5p on the month to 118.2p and 120.1p respectively.

The Consumer Price Index, including owner-occupiers’ housing costs (CPIH), was 2.8% in September, up from 2.7% in August.