Supermarket sales of mouthwash soar as socialising returns

But overall grocery sales dropped compared with a year ago at the height of the pandemic, according to Kantar

With households allowed to socialise again, shoppers appeared keen to make a good impression as sales of mouthwash, hairstyling products and shoe polish soared in recent weeks, according to new data.

But as the public head to restaurants and bars again, overall supermarket sales cooled compared to a year ago at a time when shelves were stripped bare and panic buying set in.

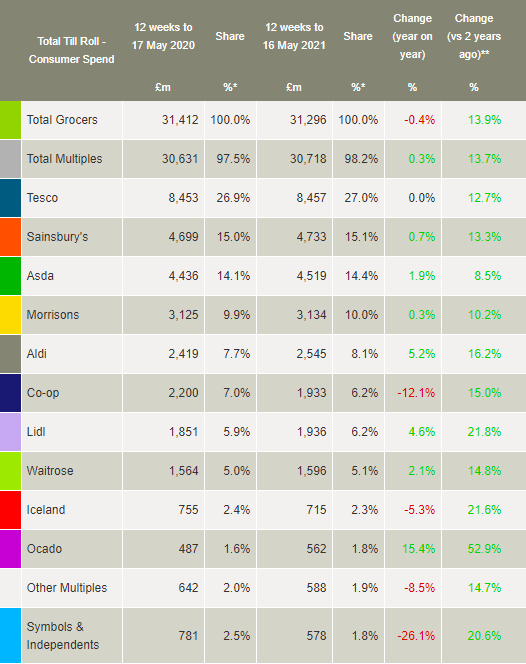

Sales in the 12 weeks to May 16 compared with the same period a year ago fell 0.4% to £31.3 billion, according to Kantar, although they remain £3.8 billion higher than pre-pandemic levels.

Co-op and Iceland supermarkets took the biggest hit at the tills, with Lidl and Aldi enjoying the largest rises.

“Many of us this time last year were eating all our meals at home and we bought extra food and drink as a result.

“Now we’re seeing take-home grocery sales dip versus 2020 as people are able to eat in restaurants, pubs and cafes and can pick up food on the go again, grabbing a sandwich, for example, while they’re out and about at the weekend.”

He added that on-the-go grocery sales look set to be a significant driver of growth for supermarkets over the next few months.

Shoppers also felt more confident heading to stores again, with 58 million more visits to supermarkets compared to May last year, with the biggest growth in London where trips were up by a quarter.

Data suggests that customers are returning to previous habits of making more regular trips, rather than doing big weekly shops as they were doing during the height of the pandemic, he added.

Online grocery shopping also fell from 13.9% of total spend in the sector to 13.4% – although it remains higher than before the crisis and the number of customers heading to independent and convenience stores also dropped.

Mr McKevitt added: “During the first national lockdown last year many people found solace in the early summer sunshine, something 2021 has so far failed to deliver.

“This saw sales of barbecue staples like burgers fall in May by 20% year on year. Chilled desserts, up by 14%, fared better – no doubt buoyed by those hardy people braving the weather to entertain friends and family in the garden.”

With households able to socialise again, quick cooking times became more important, with a 20% rise in chilled ready meals, 28% jumps in cooked chicken and fillings for sandwiches rising 12%.

Splitting out individual supermarkets, discounters Aldi and Lidl had the best performing period – benefiting from customers returning to stores, with both not offering online deliveries.

Aldi sales rose 5.2% and Lidl by 4.6%.

Of the Big Four supermarkets – Tesco, Sainsbury’s, Asda and Morrisons – Asda enjoyed the biggest rise, growing 1.9%.

But Co-op saw a heavy decline of 12.1% compared with a year ago and Iceland suffered a 5.3% drop in sales.