Kwasi Kwarteng axes top income tax rate for highest earners

The Chancellor announced a raft of tax cuts in a mini-budget.

Chancellor Kwasi Kwarteng abolished the top rate of income tax for the highest earners as he spent tens of billions of pounds in a “gamble” to drive up growth during a cost-of-living crisis.

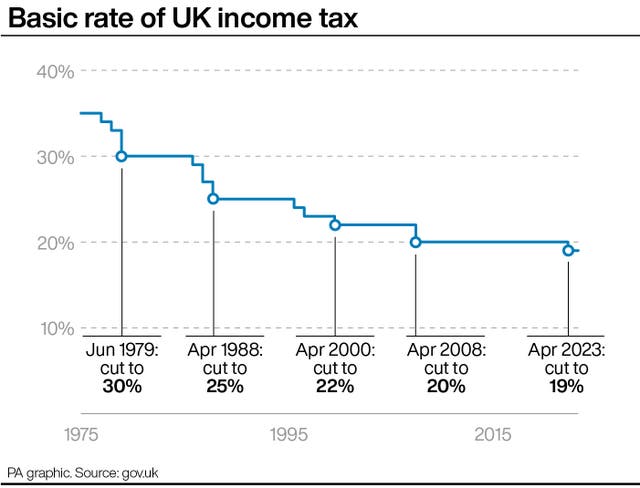

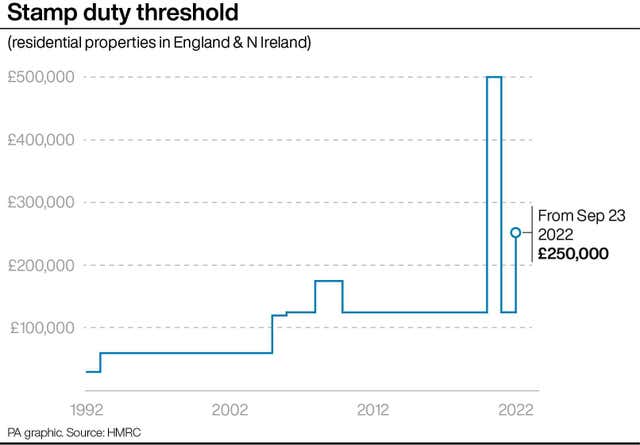

Using more than £70 billion of increased borrowing, Mr Kwarteng also brought forward a planned cut to the basic rate of income tax to 19p in the pound a year early to April and reduced stamp duty for homebuyers.

He argued tax cuts are “central to solving the riddle of growth” as he confirmed plans to axe the cap on bankers’ bonuses while adding restrictions to the welfare system.

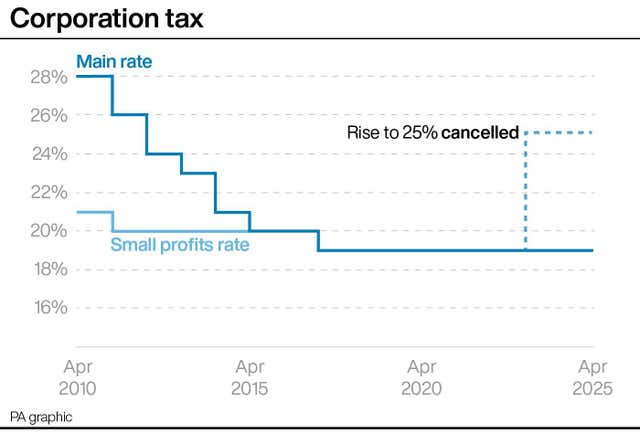

Treasury estimates put the measures, including Liz Truss’s promises to reverse the national insurance rise and axe the hike to corporation tax, as costing nearly £45 billion a year by 2026.

From April, the 660,000 earners getting more than £150,000 a year will no longer pay the top income tax rate of 45% and will instead pay the 40% applicable to those on more than £50,271.

However, shadow chancellor Rachel Reeves said the strategy amounts to an “admission of 12 years of economic failure” under successive Conservative governments.

The Labour MP likened the Prime Minister and Mr Kwarteng to “two desperate gamblers in a casino chasing a losing run”.

The pound dived to another fresh 37-year low as traders swallowed the cost of the Chancellor’s latest package and potential impact on Government borrowing.

The major spending package included:

– Cuts to stamp duty meaning the exemption level was immediately doubled from £125,000 to £250,000 while the exemption for first-time buyers increased from £300,000 to £425,000

– The introduction of VAT-free shopping for overseas visitors

– Legislation to force trade unions to put pay offers to a member vote so strikes can only be called once negotiations have fully broken down

– Confirmation of plans to make around 120,000 more people on Universal Credit take active steps to seek more and better-paid work or face having their benefits reduced.

The package was announced a day after the Bank of England warned the UK may already be in a recession and lifted interest rates to 2.25%, making Government borrowing more expensive than at any point over the past 13 years.

Paul Johnson, the director of the Institute for Fiscal Studies economic think tank, said Mr Kwarteng’s “big gamble” was the “biggest tax-cutting event since 1972”.

“This will, I am sure, lead to the Bank of England increasing interest rates more than they otherwise would do,” he told BBC News.

“This is a big gamble. There is a chance it will pay off.

In the surprise move of what had been dubbed a mini-budget, Mr Kwarteng argued the top rate of income tax is higher than the headline top rate in G7 allies like the US and Italy.

“I’m going to abolish it altogether,” he said, announcing the policy, which will cost around £2 billion a year from 2025.

Cutting the top rate of income tax will save the top earners, on average, £10,000 a year, according to Treasury estimates.

But Torsten Bell, the chief executive of the Resolution Foundation think tank, said those earning £1 million annually will get a £55,000 tax cut next year.

On bankers’ bonuses, Mr Kwarteng argued the cap to limit them to twice salaries “never capped total remuneration”, adding: “So we’re going to get rid of it”.

Royal College of Nursing chief Pat Cullen urged members to back strike action as she struck out at the package that gives “billions to bankers and nothing to nurses”.

However, the Joseph Rowntree Foundation said it shows the Government has “no understanding of the economic reality facing millions across the UK”.

Rebecca McDonald, the chief economist at the anti-poverty charity, said: “This is a budget that has wilfully ignored families struggling through a cost-of-living emergency and instead targeted its action at the richest.”

To cover the costs of the tax cuts, the Treasury estimates the package would have to drive up GDP by 1% on current forecasts every year for five years.

The Treasury said the total package would be funded by increasing borrowing by £72.4 billion.

The net cost of reversing Boris Johnson and Rishi Sunak’s 1.25 percentage point increase to national insurance imposed in April was put at around £15 billion per year.

Axing their planned corporation tax rise by maintaining it at 19% was set to come in at £18.7 billion a year by 2026.

The Chancellor avoided the immediate scrutiny and forecasts of the Office for Budget Responsibility by describing the package as a “fiscal event” rather than a full budget.

Ms Reeves said: “Never has a Government spent so much and explained so little.”