Bank could cut UK interest rates but decision a ‘close call’, experts say

Expectations on financial markets show about a 65% chance of the Bank of England’s policymakers opting to reduce rates on Thursday.

The Bank of England could be encouraged to cut interest rates for the first time in more than four years amid growing evidence that inflation has been tamed, experts have said.

Expectations on financial markets show about a 65% chance of the Bank’s policymakers opting to reduce rates on Thursday.

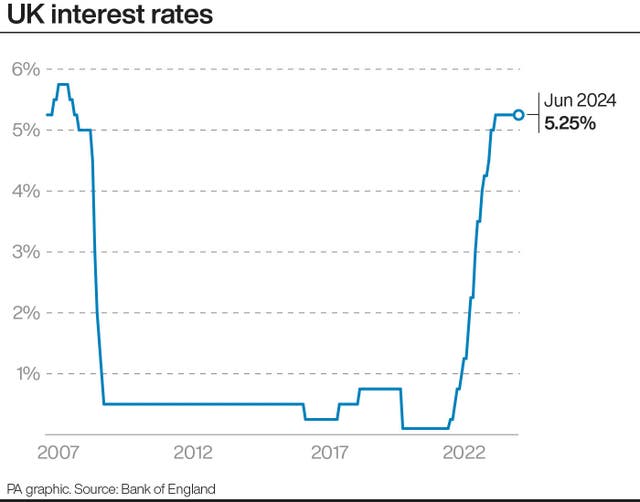

The UK’s base rate has been held at 5.25% since August last year, the highest level since 2008.

It comes after new economic data suggested the UK’s cost-of-living crisis has eased in recent months thanks to inflation coming off the boil.

Consumer Prices Index (CPI) inflation hit 2% in May and June, which is the central bank’s target level, indicating that price rises have been brought under control.

Economists stressed that other key indicators of inflationary pressure – mainly services inflation and wage rises – have remained a concern for policymakers.

James Smith, developed market economist for ING, said it will be a “close call” but he expects a majority of policymakers to vote in favour of a 0.25 percentage point rate cut on Thursday.

“More recently, services inflation has been propped up by a spike in hotel prices,” he said, suggesting the Bank could be less concerned by the “highly volatile” data.

“The bottom line is that there is just about enough in the recent data to give the Bank confidence to begin lowering rates,” Mr Smith concluded.

Sanjay Raja, senior economist for Deutsche Bank, also predicted that rates will be cut to 5% but stressed it will be a “delicate balance”.

He said Bank governor Andrew Bailey could be among the members on the Monetary Policy Committee (MPC) opting for a rate cut.

On the other hand, Andrew Goodwin, chief UK economist at Oxford Economics, said the MPC could hold rates at 5.25% for another month.

Experts at Pantheon Macroenomics agreed that policymakers could keep rates on hold in August but “signal they expect to cut rates in the coming months”.

“The swing voters — Andrew Bailey, Clare Lombardelli and Sarah Breeden — have not spoken since the General Election, which could suggest they are not ready to take the plunge,” Pantheon’s economists said.

Laith Khalaf, head of investment analysis at AJ Bell, said Thursday’s decision will be more “symbolic than substantial”.

“A rate cut marks an entry into a new phase of interest rate policy, but at street level the reality is financial conditions won’t change much,” he said.

“Especially for the horde of people who will be rolling off cheap fixed-rate mortgages this year and encountering a new and bracing financial reality.”