16,712 reasons to send for Charlie

PICK a number this week and it has to be 16,712.33.

That’s the amount in pounds sterling government pay costs have increased every day for the last 10 years. To save you the maths, that’s an extra £61m. added to States costs that you and I have had to find. Without that, we’d all have an extra £1,500 in our back pockets.

Well, if tax was applied evenly that is. The latest figures I obtained from Frossard House (2017) show that half of all income tax revenues were generated by the top 15-20% of taxpayers. A quarter is generated by the top 4%, or say 1,500 individuals.

That’s pretty frightening as it shows we’re heavily dependent on people earning more than £100,000 a year to keep the island afloat, while the two biggest pay groups, totalling about 12,000 individuals, earn between £20,000 and £40,000.

Remove the high-fliers and, bluntly, we’re screwed. This lesson in fragility was underlined over the weekend with the world’s seven largest economies agreeing to press for a minimum corporate tax rate of 15%. While it’s too early to say that means chirrie to zero-10, it does reinforce chief minister Peter Ferbrache’s call for ‘eyeballing’ the public sector unions about savings and reforms.

Last year, for instance, States pay costs rose by nearly 1% more than inflation and the pension scheme – still predominantly a defined (final salary) benefit scheme with the taxpayer holding all the investment risk – has collapsed to a funding level of 57.1% compared with 93.5% in 2016 and is significantly in deficit.

How badly isn’t directly disclosed in the latest States accounts (I’ll tell you what it is in a moment) but will be when the moves towards declaring government finances on a recognisable accounting basis are complete. After that happens, says States Treasurer Bethan Haines, ‘the full impact of any increase in the pension deficit will be charged to the States’ reserves’.

And that won’t be pretty. The scheme’s current obligation is to pay pensions totalling £2.8bn, while the fund value is ‘just’ £1.6bn – a shortfall of £1.2bn. I should mention that the States’ reserves at the end of last year had fallen to just shy of £700,000m.

All of which explains why public sector cost and operational reforms are so desperately needed. But not how.

Historically, of course, the States hasn’t really been bothered about it. Too hard, too few States members are equipped to do it and anyway, we muddled through the 2008 great crash without that much difficulty.

No one, not even Scrutiny, questions why pay rates here are higher than in the UK, why levels are set as high as they are or why key appointments aren’t routinely opened to non-civil servants.

Committees don’t, on election, ask their advisers to produce a list of what the department does, what as a minimum it is obliged by law to do or what it ought to be doing but isn’t. There is no line by line trawl through department organisation charts challenging what benefit a tree protection officer provides or whether the private sector would provide the same service for 50 quid a pop, no pension required.

Some years ago I asked a then fresh-faced Treasury minister called Gavin St Pier and an equally boyish Paul Luxon, then running Public Services, whether this newspaper could have copies of departmental organisation charts plus their management accounts to assist in identifying potential savings.

Subject to workable caveats, they were agreeable. The civil service was not, however, and a useful exercise in transparency bit the dust as the bureaucrats fought a successful rearguard action. Perhaps I should ask again, since we’re supposed to have an access to public information that’s now a FoI in all but name…

That said, I’m far from certain States members themselves receive monthly management accounts for their departments, have any idea how much is spent on what in their name, or whether it’s true their officials do all they can to spend budgets ahead of year-end to use them all up.

What is true, however, is that taking cost out of an organisation, reducing headcount, flattening management tiers, outsourcing and stopping non-essential activities is extremely difficult. It takes skill, tenacity and a proficient HR department – and wide acceptance that such pain is necessary for the longer-term benefit or survival of the entity.

The States of Guernsey, generally, doesn’t believe in such things as a burning platform – the taxpayer’s already being worked on to cough up more – and I doubt there’s the capacity within the organisation to carry out such a review anyway.

Still, the chief minister has said P&R will give it a go, so best keep the faith. Personally, I’d bring in someone to give me a hand, remunerated on a percentage of savings achieved (not promised) and with a relevant track record.

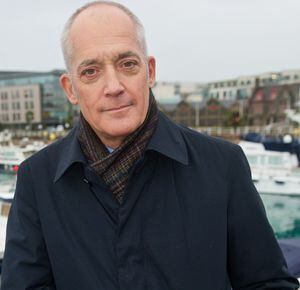

Who was that fellow in Jersey? Charlie Parker, was it? I believe he has some time on his hands.