Andy Sloan: U turn if you want to

Will we ever get to net-zero? Andy Sloan considers the issue, in light of Labour’s recent U-turn...

‘I do believe the return of inflation heralds a different economic era, with real-world consequences already apparent. For example, the economics of the transition to “net zero” suddenly feel much more painful (the reasons are complicated, as much to do with the speed of transition), threatening popular support for climate goals.’

Yes, that’s me writing last month.

Last month two years ago, that is – pretty prescient, n’est-ce pas?

But with Labour reneging on its commitment to invest £28bn annually to support climate change goals just three weeks ago, it’s quite timely for me to mention it. Indeed, because of Labour’s U-turn, several people, the editor included, suggested that I discuss Guernsey’s green investment issues this month.

Labour got rather pilloried for their move, though to be frank, the headlines were generated more by the pathological needs of the Tory press to kick Labour over something. After all, it wasn’t like the move was unexpected.

I suppose that for many, it’s taken rather a long time for the penny to drop that this climate change action thing isn’t costless. Which, as I suggested would happen two years ago, has rather undermined public support.

Truth be told, when money was free, no one was serious about doing the sums. Governments were just as culpable as the campaigners. Former UK Chancellor Philip Hammond’s recent comments that more financial analysis was conducted over banning plastic straws than over the UK commitment to net-zero has just intensified criticism from climate change sceptics.

I was over in London just after Labour’s announcement, speaking at a Lord Mayor event at Mansion House.

It was great fun, and being in London gave me the opportunity to immediately take the temperature on the issue. I was surprised just how much of an impact the announcement had had on some. I personally thought the tide of popular support had been going on for some time now; I’ve regularly commented on it, but to those I spoke to, it had been a bit of a watershed moment.

Back home, I got asked if the roll-back of Labour’s investment commitment had any read across for us locally, to which I rather tongue-in-cheek suggested that since we hadn’t made any investment plans to meet net zero, we had none to roll back. Fact is we’re still at the thinking-about-it stage, which means there must be an expensive £250k consultants’ report in the works.

But let’s scope out the issue today.

The good news is achieving net zero as an island is really going to be down to significant action in just a few policy areas. There’s less than a handful of material local issues to figure out, but for sure, they’re a handful, if you’ll excuse the pun. What we just need is a clear strategic approach to each. This might be a little unpopular, but nothing is really going to be achieved by calculating and reporting personal or company carbon footprints. However virtuous it might make us feel, it’s not really helping. For an excellent precis of this point, do read deputy editor Helen Hubert’s November 2021 column (it’s on the website).

The big two areas for us are transport and energy. Sort those and we’re more or less there. So how to fix?

Let’s assume we’ll just slipstream UK and EU policy on internal combustion engines, and we’ll all be driving whatever the manufacturers are making in 2050.

We’ll need more electricity generation for sure (factored into the estimates below), but job done. And let’s also assume that it’s unlikely Guernsey is going to solve the global aviation problem from Guernsey. We might want to see if we can help get Mark Harrisson’s Green Air up and running; I, for one, think it’s worth running the slide rule over, but following the global path is the most likely scenario.

Ditto construction, at some point net-zero building materials and standards will be figured out elsewhere and we’ll just be able to apply them locally.

So really, it’s just energy. Those nice people at Siemens worked out various alternative routes for spending £500m. to generate pretty much all our energy needs by 2050 in a clean manner. That leaves us to convert the 12-15,000 properties running on oil and gas to electric, and manage the transition which includes the sensitivities of suppliers of a dying market. So throw in £10-15k each and £150-£200m. or so covers it. We end up with a crude estimate of £750m. Pure back of the fag packet stuff.

Speaking at YouthAction4ClimateGSY in 2019 at the Grammar School, I’d used a heuristic (rule of thumb) and come up with a similar estimate. What I said then was: ‘If we’re looking at the scale of the investment that’s going to be required, we need to understand what we’re talking about. There’s no point talking about jolly good ideas without appreciating the actuality.

That [£750m.] happens to be around the scale – I’m not saying it’s exactly right – of what is possibly required in terms of subsidies and investment to move to electrification of the automobile, and also looking at zero-carbon electricity generation as a project to be used towards that. Both of those are key aspects that we need to do domestically.’

As Warren Buffet says, it’s better to be approximately right rather than exactly wrong, and these two guesstimates five years apart are uncannily similar, which provides me a reasonable degree of confidence that this £3/4bn is in the right ball park. As a final triangulation, Labour’s £28bn pa equivalises to £800m. in Guernsey terms, so we’re close enough for a working approximation. And that’s a gross figure – over 25 years, much of the capital stock would need to be replaced anyway over a quarter of a century, so perhaps not so scary a figure. But it’s still money to be found from somewhere. Tricky, eh? Who’d want to be a deputy.

Personally, I think the bigger problem is funding all this, given the underlying state of the economy. Economic conditions aren’t exactly propitious. And that’s not changing anytime soon. I wrote at Christmas about living with the hangover of the global policy mistakes of the 2010s, ‘the decade of putting it off’ – we’re going to be living with that for a very long time. As an economist, I’ve got my head around for just how long, but I suspect many have not.

This isn’t a doing Guernsey down point – western Europe just hasn’t gotten any richer over the last decade or so, Guernsey with it.

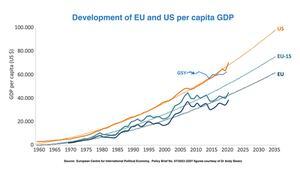

In that context, things are much more difficult to afford. I came across an article in Le Monde recently which illustrates the point. ‘The GDP gap between Europe and the United States is now 80%’ it reported on the divergence in growth (and productivity growth) between the US and the EU since the global financial crisis. The story is the same for the UK (dug out the source report and overlaid the Guernsey figures on the accompanying graphic). This rather helpfully explains that this economic stagnation is a geographic phenomenon, i.e. the issue is structural to western Europe, and clearly there’s no quick fix.

My point? The task is financing a path to net-zero while mired in an economic stagnation situation common with our large near neighbours. Net-zero is one of many competing priorities for resources, it needs funding and can’t be ignored. It’s a real guns or butter conundrum. Google if you’re not following. And it’s the cost in the current poor economic circumstances that’s led to the ebbing of support for climate action.

When it was a free lunch, everyone was up for it. Not so much nowadays. So it was most unhelpful for Labour to be seen to be putting everything off to another day with their policy U-turn.

So, thinking about it properly, I do understand now why so many I spoke to in London a few weeks ago were aghast.

The $64m. question is whether globally or locally we’ll get there? Whether, alongside any alleviating effects of techniques and technologies that we haven’t yet developed, we’ll manage to figure out a way to fund the necessary net-zero investment.

Or is it really a case of it’s never going to happen, the costs are just too high and the threats too existential to maintain public support for spending the sums involved?

I thought a poll on this question would be an interesting exercise, so I took to X and LinkedIn. It was a close-run thing. On LinkedIn, optimists outweighed pessimists 60% to 40%. On X, it was slightly the other way, with pessimists outweighing optimists, 55% to 45%. But across both media, overall, the optimists slightly had it.

I hope they’re right. I think they are.

Sorry for being a bit serious this month, but I’ve a promise to keep that I’d try and keep the issue in the public eye.